Understanding Payment Methods for Utility Bills in Japan in 2024

One of the essential tasks when living in Japan is understanding how to pay your utility bills on time. Whether it’s electricity, gas, or water, paying these bills is crucial to avoid service disruptions. There are multiple ways to settle your bills in Japan, and knowing these methods can save you time, hassle, and even extra fees. In this guide, we’ll cover the most popular payment methods: convenience store payments, bank transfers, and credit card payments. For a more in-depth look at reading your electricity bill, check out our article on Understanding Your Electricity Bill in Japan.

1. Convenience Store (Konbini)

Convenience store payments (known as “Konbini” in Japan) are one of the most accessible methods for paying your utility bills. This option allows you to pay at major convenience stores like Seven-Eleven, Lawson, Family Mart, and others. The process is simple and can be done in a few minutes:

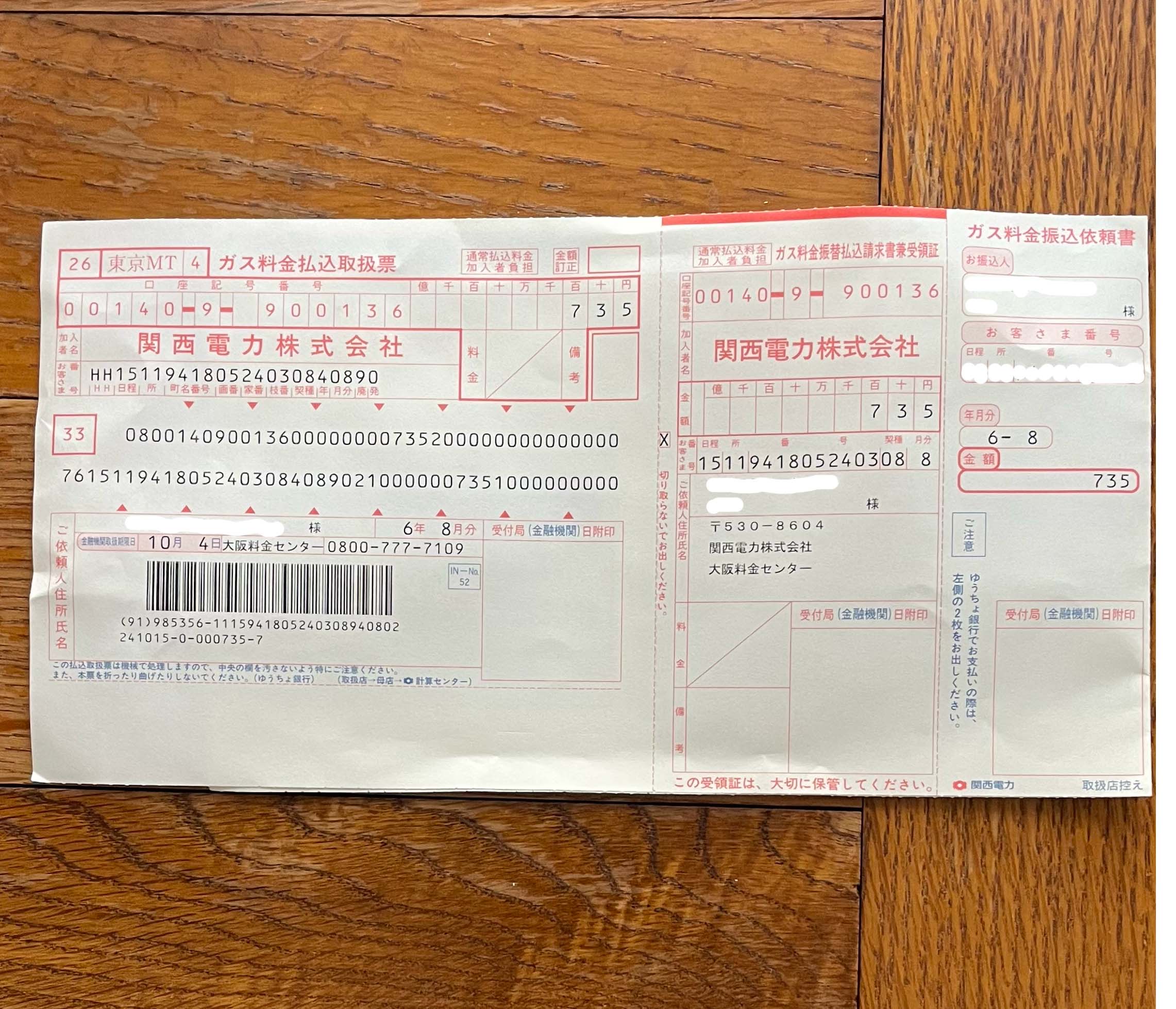

- Take the bill you receive in your mailbox to a convenience store.

- Hand it over to the cashier.

- The cashier will scan the barcode on your bill and confirm the payment amount.

- Once you pay, the cashier will give you a receipt with a stamp as proof of payment (the blue part in the image)

It’s important to keep this receipt, as it may be needed if the company questions your payment or in case there is any billing discrepancy.

Changes in Konbini Payment Fees

Traditionally, paying your utility bills at convenience stores used to be free. However, due to economic and environmental reasons, many companies now charge a small fee for issuing and mailing paper bills. These fees typically range from 100 to 400 yen, depending on your utility provider. While this fee may seem small, it can add up over time, especially for monthly bills. This is one of the reasons why many people are switching to automatic payments (more on that below).

Pros and Cons of Convenience Store Payments

While convenient, paying at a konbini does require you to physically pick up your bill from your mailbox and visit the store to make a payment. This can become a bit tedious, especially if you’re busy or traveling. Additionally, since paper bills are becoming more expensive to issue, many utility companies are encouraging users to switch to other payment methods that reduce the environmental impact, such as automatic bank transfers or credit card payments.

2. Bank Transfer (Furikomi)

To avoid the hassle of making payments manually each month, many people in Japan opt for automatic bank transfers, known as furikomi (振り込み). When you sign up for this service, your utility bills will be automatically withdrawn from your bank account every month, eliminating the need to physically pay each time. Here’s how it works:

- Your utility company will send you a form after your first paper bill. This form will ask for your bank account details so that they can set up automatic payments.

- Fill out the form with your account information and send it back to the utility company via mail. (Most forms will come with a return envelope, and no postage is required.)

- It typically takes about a month for your application to be processed, so you may need to continue paying at a convenience store or using another method until your automatic payments begin.

Once the process is complete, your utility bill will be deducted from your bank account on the due date, and you’ll receive a notification and receipt in your mailbox to confirm the transaction.

Why Choose Bank Transfers?

Bank transfers offer convenience and peace of mind, as you’ll never have to worry about missing a payment due to forgetfulness or being out of town. It also helps you avoid extra fees for paper bills and ensures your payments are made on time, which can help maintain a good payment record. However, one downside is the initial setup process, which can take a few weeks.

3. Credit Card Payments

Another popular method for paying utility bills in Japan is by using a credit card. Like bank transfers, credit card payments offer the convenience of automatic monthly payments without the need to visit a store or mail in a payment.

Setting Up Credit Card Payments

Similar to the bank transfer process, your utility provider will send you a form asking for your credit card information after your first paper bill. Fill out this form and return it to the company by mail. After processing, your credit card will be charged automatically each month for the amount owed.

Benefits of Paying by Credit Card

One of the major benefits of paying by credit card is that it allows you to earn reward points or cashback on your utility payments, depending on your card’s reward system. Over time, these points can add up, offering you discounts or free items. Additionally, credit cards provide an extra layer of security for your payments.

Another advantage is that you don’t need to have a Japanese bank account to set up credit card payments. This is particularly useful for expatriates or those who are in Japan temporarily. As long as your credit card is accepted in Japan, you can use it to pay your utility bills.

Conclusion: Which Payment Method is Best?

Choosing the right payment method for your utility bills in Japan depends on your preferences and lifestyle. If you prefer convenience and don’t mind visiting a convenience store every month, paying at a konbini may be a good option. However, if you value ease and never want to worry about missing a payment, setting up an automatic bank transfer or credit card payment is probably the way to go.

Many residents in Japan are moving away from paper bills due to the added cost and environmental concerns. Automatic payments not only help save time but also reduce the risk of missing a payment.

No matter which method you choose, understanding how to pay your utility bills is key to managing your finances in Japan. Make sure you keep track of due dates, and if you opt for manual payments, always keep your receipt as proof in case any issues arise.